Unlock Your Investment Potential With The Northern Bond Index Fund: Click Now To Maximize Returns!

Discover the Northern Bond Index Fund: A Smart Investment Choice

Introduction

Hello Happy Readers,

Welcome to our informative article on the Northern Bond Index Fund. In this comprehensive guide, we will explore the ins and outs of this investment option and shed light on its potential benefits. Whether you are a seasoned investor or just starting your journey, this article will provide valuable insights to help you make informed decisions.

3 Picture Gallery: Unlock Your Investment Potential With The Northern Bond Index Fund: Click Now To Maximize Returns!

So, let’s delve into the world of the Northern Bond Index Fund and discover what makes it a smart choice for investors.

What is the Northern Bond Index Fund?

📈 The Northern Bond Index Fund is a popular investment vehicle designed to track the performance of a specific bond index. It aims to replicate the investment returns of the index it follows, offering investors exposure to a diversified portfolio of bonds.

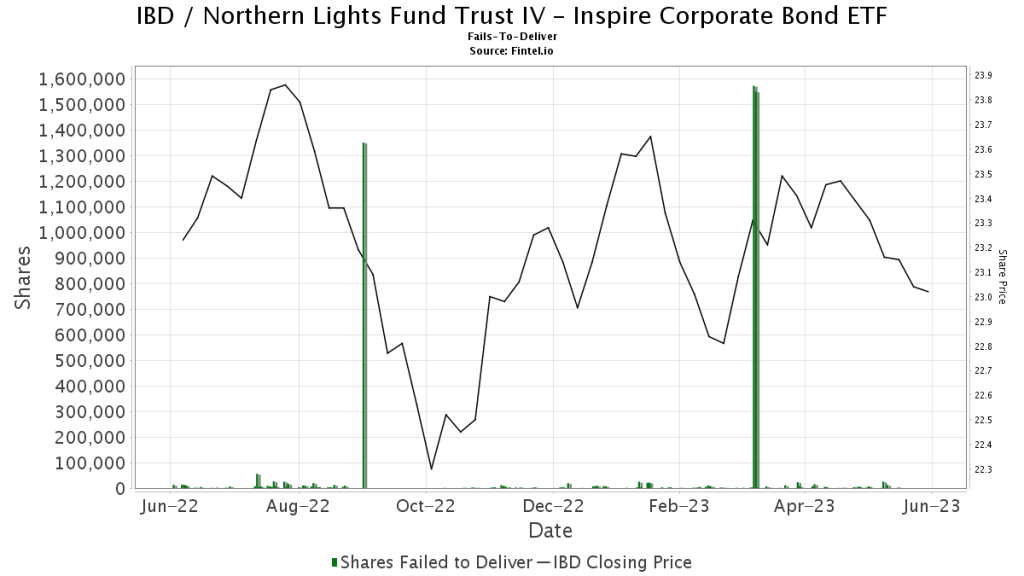

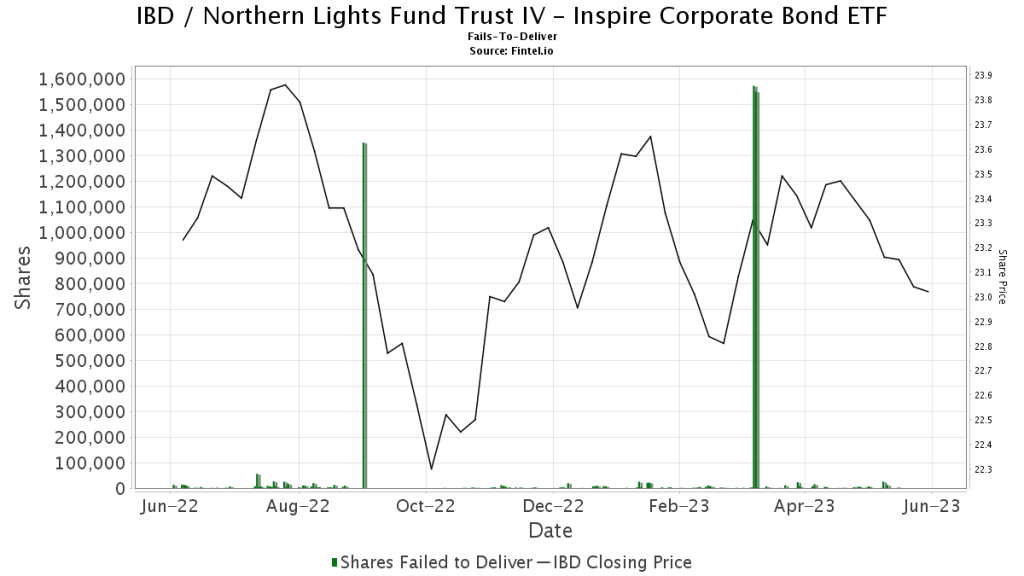

Image Source: fintel.io

This passively managed fund is known for its low fees and broad market exposure, making it an attractive option for investors seeking stability and long-term growth.

How does it work?

The Northern Bond Index Fund works by investing in a wide range of bonds that are included in the underlying index. The fund manager replicates the index’s composition, ensuring that the fund’s performance closely mirrors that of the index.

By investing in this fund, investors gain access to a diversified portfolio of bonds without the need to individually purchase and manage each bond. The fund’s holdings are periodically adjusted to maintain alignment with the index, ensuring that investors continue to benefit from the index’s performance.

Who can invest in the Northern Bond Index Fund?

🤔 The Northern Bond Index Fund is suitable for a wide range of investors. Whether you are an individual investor, a pension fund, or a financial institution, this fund offers an attractive investment opportunity.

Image Source: boltdns.net

Individual investors looking to diversify their portfolios, manage risk, and potentially earn stable income over the long term can consider investing in this fund. Institutional investors, such as pension funds, can also benefit from the fund’s low fees and broad market exposure.

It is important to note that before investing in the Northern Bond Index Fund, investors should carefully assess their risk tolerance, investment goals, and consult with a financial advisor for personalized advice.

When should you consider investing?

⌚ The ideal time to invest in the Northern Bond Index Fund depends on your investment goals and market conditions. If you are seeking stability and long-term growth, this fund can be a suitable option.

Consider investing in this fund when you have a long-term investment horizon and are looking to diversify your portfolio. Additionally, market conditions, such as interest rate trends and economic indicators, should be considered before making investment decisions.

Where can you invest in the Northern Bond Index Fund?

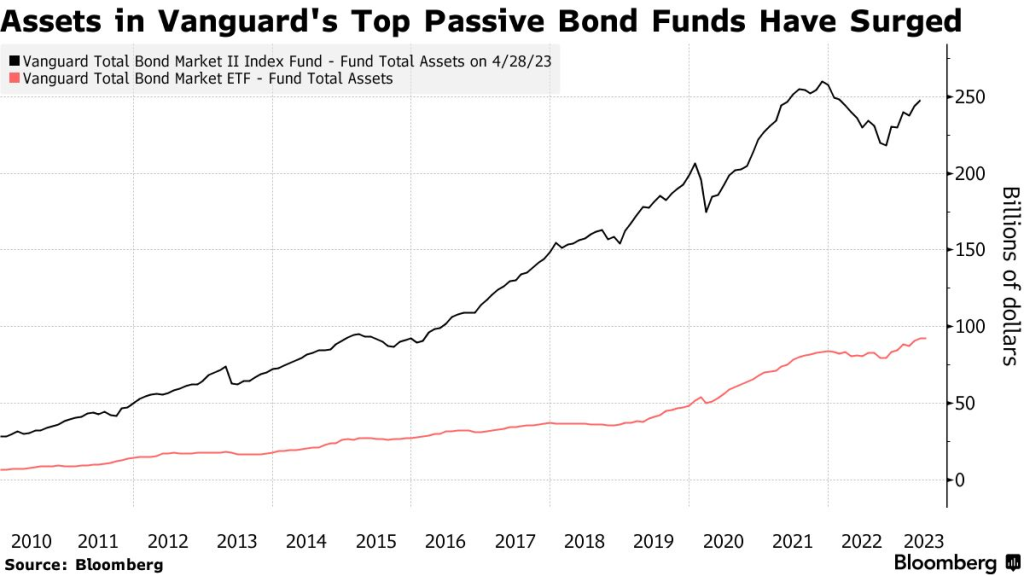

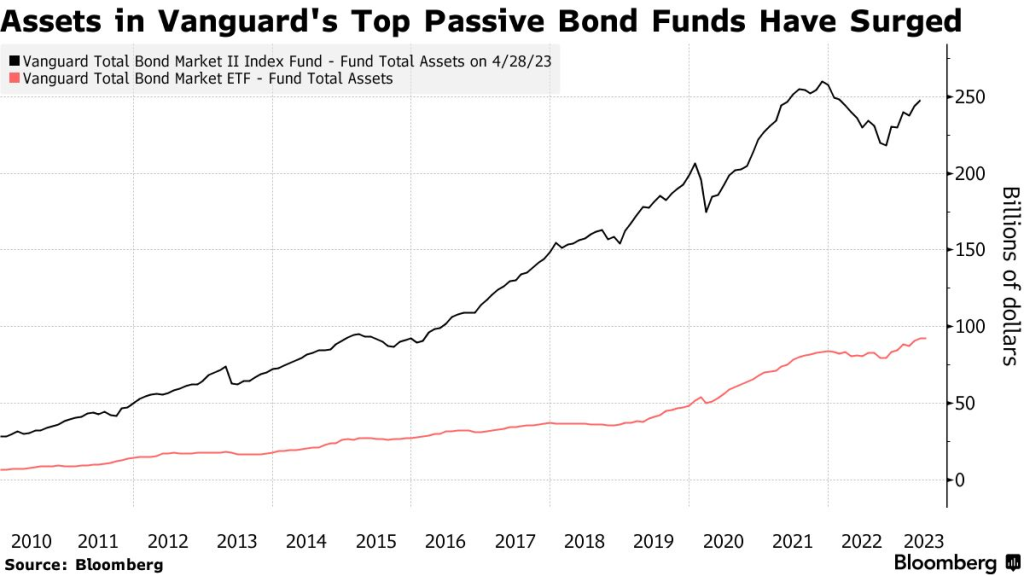

Image Source: bwbx.io

🌍 The Northern Bond Index Fund is a globally recognized investment option, available to investors in various regions around the world. It can be accessed through reputable financial institutions, such as banks, asset management firms, and online investment platforms.

Before investing, it is essential to choose a reliable platform or institution that offers the Northern Bond Index Fund and ensures secure and transparent transactions.

Why choose the Northern Bond Index Fund?

🔍 The Northern Bond Index Fund offers several compelling advantages that make it an attractive investment choice:

1️⃣ Diversification: By investing in this fund, investors gain exposure to a diversified portfolio of bonds, reducing the impact of individual bond performance on their overall investment returns.

2️⃣ Cost-Effective: The Northern Bond Index Fund is known for its low fees compared to actively managed funds. This cost-effectiveness can improve investors’ net returns over the long term.

3️⃣ Transparency: As a passively managed fund, the Northern Bond Index Fund provides transparency in the selection and management of its holdings. Investors can easily access information about the underlying index and the fund’s composition.

4️⃣ Stability: The fund’s focus on bonds provides potential stability to investors’ portfolios, as bonds are generally considered less volatile than equities. This stability can be particularly appealing during uncertain market conditions.

5️⃣ Performance: The Northern Bond Index Fund aims to replicate the performance of the underlying index. By tracking the index, the fund offers potential returns that align with the overall bond market performance.

What are the disadvantages of the Northern Bond Index Fund?

⚠️ While the Northern Bond Index Fund offers numerous advantages, it is essential to consider the potential disadvantages:

1️⃣ Limited Flexibility: As a passively managed fund, the Northern Bond Index Fund does not allow for active decision-making regarding the fund’s holdings. Investors cannot capitalize on specific market opportunities or adjust the portfolio based on changing market conditions.

2️⃣ Market Dependency: The fund’s performance is directly tied to the performance of the underlying bond index. If the index underperforms, the fund’s returns may also be negatively affected.

3️⃣ Interest Rate Sensitivity: Bond prices are inversely related to interest rates. If interest rates rise, bond prices may decrease, impacting the fund’s performance. Investors should carefully consider interest rate trends when investing in the Northern Bond Index Fund.

4️⃣ Inflation Risk: Inflation erodes the purchasing power of fixed-income investments like bonds. The Northern Bond Index Fund may be more vulnerable to inflation risk in certain economic environments.

5️⃣ Credit Risk: Bonds carry credit risk, meaning there is a chance of default by the bond issuer. Investors should consider the credit quality of the bonds held within the Northern Bond Index Fund and assess the associated credit risk.

Frequently Asked Questions (FAQs)

1. Can I redeem my investment in the Northern Bond Index Fund at any time?

Yes, the Northern Bond Index Fund offers liquidity, allowing investors to redeem their investments at any time. However, it is important to note that market conditions and potential transaction costs may impact the redemption process.

2. Are the returns from the Northern Bond Index Fund taxable?

Yes, the returns generated by the Northern Bond Index Fund are generally subject to taxation. Investors should consult with a tax advisor to understand their specific tax obligations based on their jurisdiction and personal circumstances.

3. What is the minimum investment requirement for the Northern Bond Index Fund?

The minimum investment requirement for the Northern Bond Index Fund may vary depending on the financial institution or platform through which you invest. It is advisable to check with your chosen provider for specific details.

4. Can I include the Northern Bond Index Fund in my retirement portfolio?

Yes, the Northern Bond Index Fund can be a suitable option for inclusion in retirement portfolios. Its focus on stability and potential income generation aligns with the long-term investment goals of many individuals planning for retirement.

5. How often does the Northern Bond Index Fund rebalance its holdings?

The Northern Bond Index Fund’s holdings are typically rebalanced periodically to align with the composition of the underlying index. The frequency of rebalancing may vary depending on the specific fund and index.

Conclusion

In conclusion, the Northern Bond Index Fund presents a compelling investment opportunity for individuals and institutions seeking stability and long-term growth. With its low fees, broad market exposure, and potential for attractive returns, this fund offers a smart choice for diversifying portfolios and managing risk.

However, it is crucial for investors to carefully assess their investment goals, risk tolerance, and consult with financial advisors before making investment decisions. By understanding the advantages, disadvantages, and key considerations of the Northern Bond Index Fund, investors can make informed choices that align with their financial objectives.

Take action now!

Don’t miss out on the potential benefits offered by the Northern Bond Index Fund. Start exploring this investment option with a trusted financial institution or online platform today. Remember to prioritize thorough research and seek professional advice to make the most of your investment journey.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. Investing in the Northern Bond Index Fund or any other investment vehicle involves risk. It is advisable to conduct thorough research, assess your individual circumstances, and consult with financial professionals before making investment decisions. The writer and publisher of this article are not responsible for any losses or damages incurred as a result of the information provided.

This post topic: Northen